#

Fight Whitepaper

#

The Official IP Token of Combat Sports

#

Executive Summary

Fight is a licensed Web3 ecosystem that turns combat-sports fandom into ownership. It runs on three pillars:

Identity (FightID): a portable, on-chain identity for fans and fighters.

Reputation (FP points): non-transferable “Fighting Points” points that reflect participation and unlock utility.

Ownership ($FIGHT, an IP token): a Solana-based token used across the ecosystem for access, staking, governance, fees, and rewards.

$FIGHT is an IP token. It is supported by the UFC through licensing and sponsorship relationships held by Concept Labs, a core contributor to the project. UFC and Fight.ID publicly announced a multi-year collaboration to grow UFC’s digital fanbase with loyalty experiences, Prize$Fight fighter bonuses, and FightGear premium apparel aligned to the FIGHT ecosystem.

Flagship utility: Prediction Markets—a token-based, fantasy-style product synchronized to the UFC fight calendar. This utility, combined with fighter communities, merch/ticket rails, and partner activations, is designed so value accrues to $FIGHT via fees → DAO treasury → buybacks/burns and growth grants.

Why this matters: UFC gives Fight distribution and cultural legitimacy at global scale. Each fight week is an acquisition moment that drives fans through the funnel: UFC reach → FightID → FP → $FIGHT. Our long-term ambition is to onboard 700M+ mainstream fans into Web3 through simple, rewarding experiences.

#

The UFC Partnership

Public announcement and endorsement. The UFC and Fight.ID have publicly announced a multi-year collaboration aimed at uniting MMA fans with Web3 experiences built around identity, loyalty, and ownership. The announcement outlines a roadmap that includes a loyalty layer anchored in Fight.ID, the Prize$Fight bonus program for fighters, and the FightGear premium apparel line aligned with the FIGHT ecosystem. It also includes an explicit statement of support from Grant Norris-Jones, Executive Vice President and Head of Global Partnerships at TKO, affirming the UFC’s commitment to backing the Fight.ID ecosystem over the coming years. This public validation provides clarity to partners, athletes, and fans that Fight is being developed in concert with the UFC’s long-term fan engagement strategy.

Scope, placements, and distribution signal. The partnership provides recurring visibility for Fight.ID and $FIGHT across UFC’s digital footprint and during fight-week moments. In practice, this means Fight surfaces can be promoted in the same rhythm that UFC cards are announced, marketed, and broadcast. Fight can leverage pre-fight storytelling, weigh-in day buzz, live event conversation, and post-fight highlights to drive fans into simple, low-friction actions: claim a fight ID, earn FP points, and learn how to use $FIGHT inside prediction markets, staking, and fighter communities. This predictable “event cadence” is a distribution system in itself, turning every card into a funnel for identity claims and ongoing engagement.

Why this matters strategically. Partnering with one of the world’s most valuable sports brands compresses customer acquisition costs (CAC), improves conversion rates, and increases lifetime value (LTV). Instead of spending to manufacture attention, Fight taps into an existing global audience with high intent and clear behaviors around research, debate, and viewing. UFC’s cultural relevance anchors Fight squarely in mainstream sports fandom rather than a narrow crypto niche, which is essential for onboarding non-crypto users at scale. Over time, this alignment compounds: as more fans claim FightIDs and accumulate FP points, Fight gains a larger addressable base for new utilities, better cohort retention, and richer cross-selling into merch, tickets, and communities.

How value accrues to $FIGHT. UFC-amplified activations translate directly into $FIGHT usage. When fans join prediction markets, stake to enter fighter communities, or transact for merch and tickets, they generate on-chain activity and fee flows denominated in $FIGHT. Those fees are routed to the DAO treasury under transparent policies. The DAO then deploys a portion of net revenues to buybacks and burns, reducing circulating supply over time, while also funding ecosystem grants and growth programs that bring in new users. This creates a closed-loop system: UFC distribution drives engagement; engagement drives fees; fees fund buybacks/burns and further growth; and growth increases utility and demand for $FIGHT. The more Fight activates around UFC events, the stronger and more predictable this value-accrual flywheel becomes.

#

Product Stack: Identity, Reputation, Ownership

#

Fight.ID (Identity)

What it is. Fight.ID (https://fight.id) is a chain-native identity that anchors every user’s journey in the Fight ecosystem. Each FightID carries a unique handle and a portable profile that can include linked wallets, participation history (quests completed, events engaged, predictions made), badges and achievements, and the user’s access rights across Fight apps and partner surfaces. FightID is designed to be consent-based and portable: once claimed, it travels with the user across products, partners, and seasons without forcing them to start over.

Why it matters. Identity is the front door to everything we do. Fans with FightID can be recognized, rewarded, and upgraded across campaigns and products, which enables real loyalty instead of one-off promotions. For operations, FightID reduces friction (one identity, many utilities), improves safety (less multi-account abuse), and allows targeted rewards (right perk to the right fan at the right time). For partners, a consistent identity turns fragmented touchpoints into a coherent, measurable relationship with each fan.

How value accrues to $FIGHT. FightID is the on-ramp to all paid utilities that touch $FIGHT: prediction entries, staking to join fighter communities, merch and ticket rails, and more. The more identities we convert—especially through UFC fight-week distribution—the more repeat interactions flow through $FIGHT. Identity gating also reduces fraud and bot activity, which protects fee revenue and makes token sinks (fees, memberships, upgrades) more durable. In short: more FightIDs claimed → more qualified users using paid features → more fees routed to the DAO → more buybacks/burns and ecosystem growth that support $FIGHT.

#

FP Points (Reputation)

What it is. FP (Fighting Force) points are non-transferable reputation. Fans earn FP by completing quests, participating in events, contributing content and governance, and performing in prediction markets. FP is intentionally not a tradable asset; it is a scoreboard of meaningful participation tied to a user’s FightID. FP unlocks tiers, gates premium experiences, and boosts staking multipliers in fighter communities and ecosystem programs.

Why it matters. Reputation shifts incentives from short-term farming to long-term engagement. Because FP cannot be sold, the only way to “win” is to show up consistently—watch cards, make informed predictions, back fighters, participate in community decisions, and help the ecosystem grow. This design reduces churn, improves cohort quality, and rewards authentic behavior over mercenary airdrop hunting. It also helps us run fairer allowlists, raffles, and premium access since FP reflects real contribution.

How value accrues to $FIGHT. FP makes $FIGHT-denominated utilities stickier and more valuable. Higher FP boosts staking yields, unlocks better community perks, and can grant priority access to limited drops—creating strong reasons to keep staking and spending $FIGHT. Minimum-FP gates can also be applied to fighter clubs or tournaments, concentrating activity among committed users who are more likely to deposit, re-enter, and compound participation. Net effect: FP raises the frequency and depth of interactions that generate $FIGHT fees and memberships, strengthening the DAO’s buyback/burn engine.

#

$FIGHT (Ownership)

What it is. $FIGHT is the Solana-based IP token that powers entries, staking, community membership, governance, and transaction fees across Fight experiences. It is the common medium that unifies identity-driven access, reputation-driven status, and the utilities fans care about—prediction markets, fighter communities, Prize$Fight bounties, and FightGear commerce. Governance rights allow token holders to shape programs, budgets, and integrations as the ecosystem decentralizes.

Why it matters. A single token across multiple UFC-supported surfaces lowers friction for newcomers and concentrates value capture for the community. Instead of scattering attention and spend across isolated apps, $FIGHT creates one programmable loop where the same currency unlocks access, pays fees, and represents voice in governance. That simplicity is critical for onboarding mainstream fans at UFC scale.

How value accrues to $FIGHT. Every new surface adds new token sinks—prediction fees, community memberships and upgrades, staking locks with FP boosts, merch/ticket rails, and sponsorship flows. Under DAO policy, a portion of net revenues funds buybacks and burns, while another portion funds growth grants and liquidity programs that drive the next wave of users. Because UFC distribution gives us a reliable cadence of events, these sinks recur week after week: more activations → more $FIGHT usage → more fees → more buybacks/burns and growth—tightening the feedback loop between fandom and token value.

#

Flagship Utility: Prediction Markets

What it is. The Fight prediction experience is being implemented as fantasy- and culture-based games, not wagering on fight results. Fans use $FIGHT to enter skill-based challenges and make non-result predictions about the culture and cadence of MMA: card announcements, walkout aesthetics, media moments, training camps, merch themes, community polls, and creator challenges. Examples include: “Which city will host the next PPV after UFC XXX?”, “What color will O’Malley’s hair be next fight week?”, “Which gym will add a top-10 bantamweight before quarter’s end?”, “Which prospect will get a Performance of the Night interview segment?”, “Which theme will the next capsule drop reference?” Entries are scored against objective, pre-published resolution sources (e.g., official UFC announcements, fighter posts, broadcast assets, on-chain drop metadata). Beyond one-off picks, fans can join seasonal leaderboards, club tournaments inside fighter communities, and creator-hosted games that reward consistent, high-FP (Fighting Points) performance with access, badges, and prizes.

Why it matters. Prediction markets transform passive viewership into active participation. Instead of only watching, fans research matchups, discuss lines, and make informed entries—then follow every minute of action with real skin in the game. Because UFC events run on a reliable cadence, the product creates weekly utility that recurs for Fight Nights and PPVs. Over time, a skill-based metagame emerges: fans build reputations, develop strategies, and gain social clout that connects directly to FP points and fighter communities. This loop turns attention into habit, and habit into loyalty, which is exactly what is needed to onboard mainstream fans at scale.

How value accrues to $FIGHT. All core interactions are denominated in $FIGHT. Market maker/taker/settlement fees are collected in $FIGHT and distributed via a programmable split to the DAO treasury, liquidity providers, and an automated buyback/burn module governed by DAO policy. As seasonal leaderboards, FP multipliers, and fighter-club tournaments encourage fans to re-enter and stake deeper, they increase the frequency and depth of $FIGHT usage around every card. In short: UFC distribution drives entries; entries generate fees; fees fund buybacks/burns and growth; growth attracts more entrants—tightening the flywheel between fandom and token value.

Integrity and fair play by design. The product is identity-anchored: users participate with a FightID, which reduces multi-account abuse and enables anti-sybil protections and staking-velocity limits. Official results flow through vetted oracles, and any discrepancies follow a transparent DAO dispute-resolution process with clear SLAs and documentation. Market behavior is monitored by analytics partners to detect manipulation and protect honest participants, while liquidity incentives are structured to reward depth and continuity rather than short-term extraction.

Compliance posture. The prediction experience is built with jurisdictional controls from day one. Access and feature sets are adjusted through geofencing and, where appropriate, operation via or in partnership with licensed providers. In regions where regulation requires different structures, formats can be delivered as skill-based fantasy with transparent scoring and published rules. This approach allows Fight to align with applicable legal regulations, while still providing a consistent, event-synchronized product that leverages UFC’s global cadence to onboard mainstream fans into Web3.

#

Fighter Communities & Staking

What it is. Fighter Communities are on-chain fan clubs where membership is earned by staking $FIGHT. Each fighter has an associated community with defined benefits (exclusive content, AMAs, watch-alongs, merch drops, meetups, prediction tournaments, Prize$Fight bounties). Fans stake to join, maintain membership by keeping their stake active, and can upgrade tiers by increasing stake or earning more FP (Fighting Force) points. Communities are interoperable with FightID, so status and perks follow the fan across apps and seasons.

How it works (core mechanics).

Dynamic entry pricing. The required stake to join a fighter’s community rises as membership grows. Early supporters lock in lower entry costs and higher status, which rewards discovery and long-term loyalty instead of bandwagon behavior.

Reward routing. A portion of new join fees and ongoing community revenues is programmatically routed to existing members (pro-rata or tier-weighted) and to the DAO treasury. The DAO portion funds ecosystem grants and the buyback/burn engine; the member portion reinforces community flywheels and reduces churn.

FP multipliers. High-FP members receive boosted staking yields, priority access to premium experiences, allow lists for drops, and better odds in community raffles. Because FP is non-transferable, these boosts reward real participation rather than mercenary farming.

Why it matters. Fighter Communities create durable, authentic fandoms with real skin in the game—stronger than passive follows or likes. The stake requirement makes membership intentional; dynamic pricing keeps the discovery phase valuable; and FP-based boosts reward the fans who consistently show up. Operationally, communities give fighters a programmable distribution channel (content, merch, events) and give fans a structured way to support the athletes they love. Strategically, communities align perfectly with UFC’s event cadence: fight-week content, weigh-ins, and post-fight moments become programmed touchpoints that convert attention into membership, retention, and upsell.

How value accrues to $FIGHT.

Deposits and locks. Membership requires staking $FIGHT, which removes tokens from circulating supply for the duration of membership and upgrades.

Recurring micro-fees. Community actions (entries, upgrades, special tournaments, paid drops) generate $FIGHT-denominated fees. Portions route to the DAO for buybacks/burns and to members for retention, creating predictable token sinks.

FP-driven stickiness. Because FP boosts yields and unlocks higher-tier perks, members are less likely to unstake, increasing average tenure and deepening $FIGHT usage over time.

Growth loop. UFC-aligned moments bring new fans into communities → new joins increase the dynamic entry price → more fees flow to members and the DAO → the DAO funds growth and buybacks/burns → community value rises, attracting the next wave of fans.

Safeguards and governance. Community parameters (entry curves, reward splits, eligibility rules) are published in docs and governed by the DAO with fighter input and Athlete Council guidance. Identity gating via FightID mitigates sybil abuse; rate limits and audit trails preserve integrity. This governance framework ensures communities grow sustainably, remain fan-first, and continue to be clear, reliable sources of value for both fighters and $FIGHT holders.

#

Ecosystem Brands

#

FightGear

What it is. FightGear is a premium Web3 combat-sports lifestyle brand for the FIGHT ecosystem. It features limited-run capsule drops, fighter collaborations, and event-themed collections that are discoverable during fight week and major UFC moments. Access can be token-gated through FightID, with early windows or exclusive SKUs reserved for $FIGHT holders and high-FP (Fighting Force) members. Checkout supports $FIGHT alongside conventional rails so mainstream fans can participate without friction.

Why it matters. Apparel is a viral surface that travels far beyond crypto. When fans wear fighter collabs or event capsules, they extend the brand into the real world and social feeds. This broadens the top of the funnel, attracts non-crypto audiences, and converts casual awareness into FightID claims and repeat touchpoints around each card. This a traditional apparel business intended to bring revenue and profits to the Fight Ecosystem.

How value accrues to $FIGHT. Purchases, holder discounts, and secondary-sale royalties can be denominated in $FIGHT. A programmable share of net proceeds flows to the DAO treasury, which funds buybacks/burns, builder grants, and future drops. Token-gated perks and FP-based allowlists also increase the utility of holding and using $FIGHT, creating recurring, event-driven sinks that scale with UFC distribution.

#

Prize$Fight

What it is. Prize$Fight is a programmable prize-pool framework for fighter bonuses, fan challenges, and event-based bounties (e.g., “Finish of the Night,” “Fan MVP,” “Underdog Upset”). Pools can be funded by sponsors, community initiatives, or DAO allocations and are disbursed transparently on-chain, with Athlete Council guidance and DAO oversight.

Why it matters. Prize$Fight turns fan support into something tangible for athletes and creates compelling reasons for fans to participate in every card. It aligns incentives: fighters are rewarded for memorable performances; fans are rewarded for engagement and prediction skill; and sponsors gain a clear, measurable activation surface synchronized with UFC moments. What benefits the professional fighters, should benefit the fightfans. What benefits the fans, should benefit the fighters.

How value accrues to $FIGHT. Funding, pledges, and entry fees can be denominated in $FIGHT. Disbursement logic is governed by DAO policy, and a small programmable fee routes back to the treasury to support buybacks/burns and future campaigns. Because Prize$Fight clusters around fight week, it reliably drives new FightID sign-ups, FP accrual, and repeat token usage—amplifying the core value loop. Some Prize$fight bonuses will be locked until a fighter retires, thereby locking up tokens and taking them off circulation. Hence, benefiting both fighters and the community.

#

FightHub

What it is. FightHub is the long-term network of partner apps, leagues, and utilities that interoperate on the FIGHT standard: identity (FightID), reputation (FP), and ownership ($FIGHT). Partners integrate via SDKs and APIs to honor a user’s identity and status, accept $FIGHT for access and fees, and feed engagement data back into the ecosystem for rewards and governance.

Why it matters. FightHub expands the number of places where a fan’s identity and reputation matter without fragmenting them across isolated products. A unified layer lets fans carry their handle, FP, and access rights everywhere, while partners tap into UFC-synchronized distribution and an already engaged audience. This lowers integration cost, accelerates go-to-market, and compounds network effects.

How value accrues to $FIGHT. Each integration adds new utility surfaces and fee streams—subscriptions, upgrades, entries, and settlement fees—denominated in $FIGHT. Standard revenue-share routes a portion to the DAO treasury, powering buybacks/burns, liquidity programs, and builder grants that seed the next wave of partners. As FightHub grows, more touchpoints drive more $FIGHT throughput, tightening the feedback loop between real usage and token value.

#

Traction & Signals

First-party validation from UFC. The UFC has publicly announced a multi-year collaboration with Fight.ID that highlights three core pillars—loyalty experiences anchored in FightID, the Prize$Fight fighter-bonus framework, and the FightGear premium apparel line. That announcement establishes clear intent from the world’s premier MMA organization and anchors Fight within UFC’s long-term fan-engagement strategy rather than as a peripheral crypto experiment.

Fight-week distribution in the wild. The @JoinFightID social channels run recurring, card-synchronized activations—pay-per-view code giveaways, ambassador spotlights, and simple quests—that invite fans to claim a FightID, earn FP points, and learn how to use $FIGHT. Because these programs follow the UFC cadence (card announcement → weigh-ins → live event → post-fight), every fight week becomes a predictable distribution window that converts mainstream attention into on-chain participation.

Identity conversion at scale. Public quest data shows strong intent: the Galxe campaign “Claim your Fight.id!” has generated roughly 71.6K entries, indicating that a large number of fans are completing verifiable steps to join the ecosystem. This is not passive impression volume; it is explicit identity conversion that feeds directly into reputation (FP) and tokenized utilities.

Product telemetry from Fight.ID (last 30 days). Internal analytics show ~15,000 active users over the past month (~+174% versus the previous period), ~586,000 recorded events (~+272%), and ~15,000 total users added (~+173%). The daily usage curve exhibits clear fight-week surges aligned with UFC events, followed by a higher post-event baseline. In practical terms, fans are not just claiming an ID once and churning—they return to complete quests, join communities, and interact with features that lead naturally to $FIGHT-denominated flows.

Why this traction matters. These signals demonstrate that the end-to-end funnel is already functioning in the real world: UFC awareness → FightID claim (identity) → FP accrual (reputation) → $FIGHT usage (ownership/utility). First-party UFC validation lowers partner friction, fight-week programs provide recurring, low-CAC acquisition, and telemetry confirms that new users graduate from identity to repeat engagement. As this cycle repeats card after card, cohort quality improves, retention rises, and the surface area for value capture expands beyond crypto-native audiences toward hundreds of millions of mainstream fans.

How value accrues to $FIGHT. Each step in the funnel touches the token. FightID claims reduce fraud and enable targeted rewards, protecting fee revenue. FP points make staking and communities stickier, extending $FIGHT lock duration and deepening participation. Prediction entries, community upgrades, and merch/ticket rails generate $FIGHT-denominated fees. Under DAO policy, a portion of those fees funds buybacks and burns, while another portion funds growth grants and liquidity programs. The result is a durable value loop: traction drives usage; usage drives fees; fees reduce circulating supply and finance the next wave of growth—strengthening $FIGHT as the economic backbone of the ecosystem.

#

Tokenomics

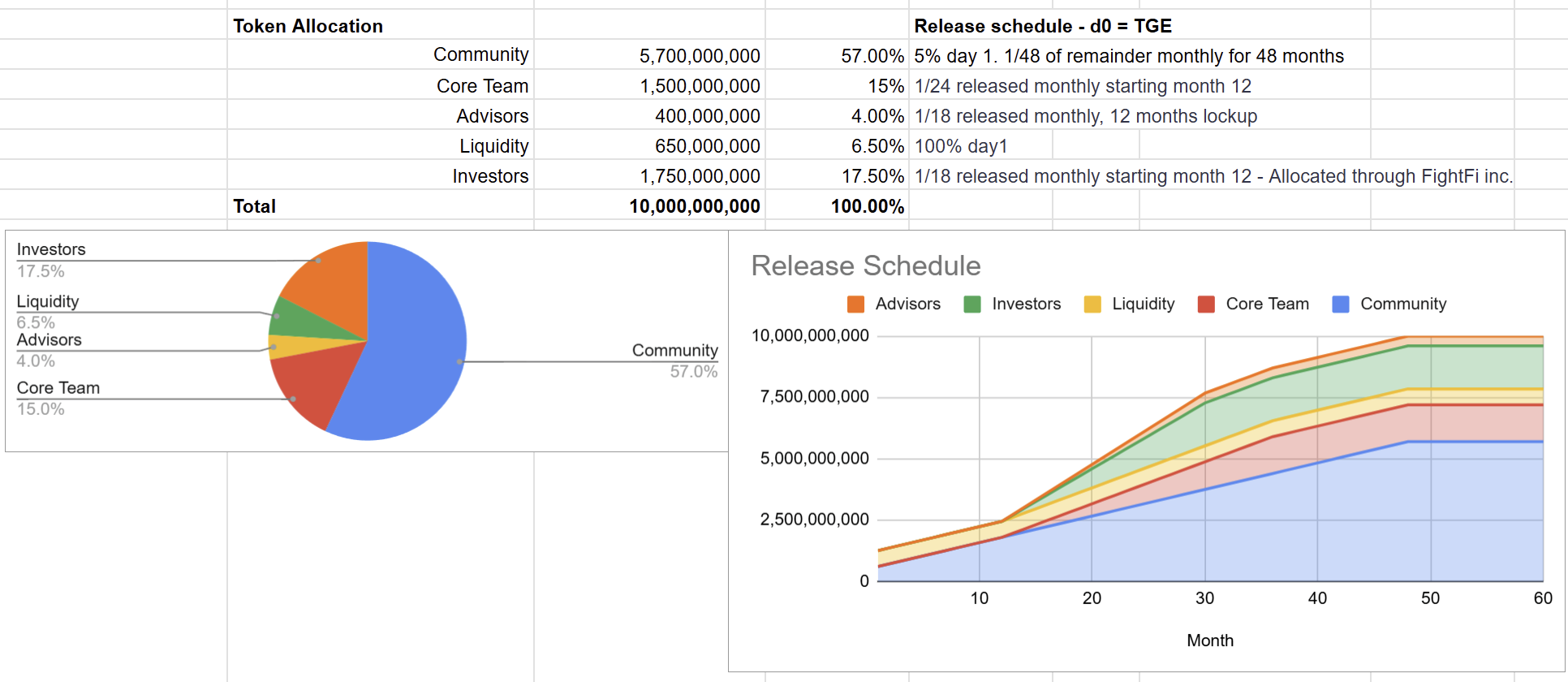

Overview and supply. $FIGHT is a Solana (SPL) IP token with a fixed maximum supply of 10,000,000,000 tokens. At the Token Generation Event (TGE), the initial price is $0.0500, implying a $500,000,000 FDV. Circulating supply at TGE is ~9.35% (935,000,000 $FIGHT). All other tokens remain locked and vest according to the schedules below. This structure establishes clear scarcity from day one while leaving ample runway for long-term ecosystem incentives.

Composition at TGE. Circulating tokens at launch consist of Community: 5% of its allocation (285,000,000 $FIGHT) and Liquidity: 100% of its allocation (650,000,000 $FIGHT). Every other category (Team, Investors, Advisors, etc..) begins fully locked. This mix enables healthy price discovery and market depth, while ensuring that short-term supply is driven by user incentives and liquidity—not early unlocks.

Why this design matters. The launch mix reduces slippage for mainstream users on day one, avoids reflexive sell pressure from large unlocks, and directs most early supply toward utility (community programs) and accessibility (liquidity). As product surfaces (prediction markets, fighter communities, merch/tickets) come online, that accessible supply is used to participate—creating transaction flow that the DAO can redirect toward buybacks/burns and growth grants.

#

Allocation and Release

#

Community — 57.0% (5,700,000,000 $FIGHT)

Release schedule. 5% at TGE, then 1/48 of the remainder monthly over 48 months.

Purpose. Airdrops, staking rewards, ecosystem grants, and community programs that bring fans, fighters, and builders into the loop.

Why it matters. A large community allocation lets us reward real participation over multiple seasons rather than burning through incentives in the first months. It aligns with UFC’s event cadence and provides consistent reasons for new and returning fans to engage.

How value accrues to $FIGHT. Community incentives increase entries, staking, and commerce that generate $FIGHT-denominated fees. Those fees flow to the DAO and are used for buybacks/burns and future growth programs—linking participation directly to token value.

#

Core Team — 15.0% (1,500,000,000 $FIGHT)

Release schedule. 12-month cliff, then 1/24 monthly over the next 24 months.

Why it matters. A one-year cliff eliminates early supply shocks from contributors and ensures the team is aligned with multi-season delivery.

How value accrues to $FIGHT. Teams are incentivized to build fee-producing utilities (prediction markets, staking programs, communities). As those utilities grow, the DAO can allocate more cash flow to buybacks/burns, strengthening the token while contributors vest gradually.

#

Advisors — 4.0% (400,000,000 $FIGHT)

Release schedule. 12-month lockup, then 1/18 monthly over 18 months.

Why it matters. Strategic help is rewarded without introducing early sell pressure. Advisors are encouraged to focus on distribution, listings, and partnerships that compound over time.

How value accrues to $FIGHT. Advisors help open new surfaces where $FIGHT is used (exchanges, partners, commerce). More surfaces mean more sinks and fees, which the DAO recirculates into buybacks/burns and ecosystem grants.

#

Liquidity — 6.5% (650,000,000 $FIGHT)

Release schedule. 100% at TGE for AMMs/CEXs and risk buffers.

Why it matters. Deep, reliable liquidity is essential for onboarding mainstream users and enabling prediction entries and community stakes at scale.

How value accrues to $FIGHT. Healthy order books reduce slippage and encourage repeat participation. As activity rises, fee throughput into the DAO rises, supporting buybacks/burns and sustained incentives.

#

Investors — 17.5% (1,750,000,000 $FIGHT)

Release schedule. 12-month lockup, then 1/18 monthly over 18 months. Allocations are administered through FightFi Inc.

Why it matters. Long lockups align capital with product maturity and exchange expansion. Post-cliff linear releases avoid step-function unlock shocks that can destabilize markets.

How value accrues to $FIGHT. Investor support (liquidity partnerships, distribution, market access) helps scale the number of places $FIGHT is used. As utilization expands, fee flow into the DAO grows, enabling larger buybacks/burns and more aggressive user growth programs.

#

Emissions, Governance, and Value Policy

Emissions discipline. All unlocks are predictable, on-chain, and reported through public dashboards. No discretionary emissions outside of DAO-approved programs. This transparency lets partners and users plan participation without fear of hidden supply.

DAO value policy. Under published policies, a portion of net revenues from prediction markets, fighter communities, merch/tickets, and partnerships is routed to the DAO treasury. The DAO dedicates part of these flows to buybacks and burns (reducing circulating supply over time) and part to ecosystem grants, LP incentives, and growth (increasing surfaces where $FIGHT is used).

Why it matters. Clear unlocks + recurring fee sinks = credible scarcity and durable utility. Combined with UFC-synchronized distribution, this creates a flywheel: events drive users; users drive fees; fees fund buybacks/burns and growth; growth creates more tokenized utility for the next cohort—compounding value into $FIGHT over multiple seasons.

#

Revenue Model (How We Capture Value and Return It to $FIGHT)

#

Prediction Markets

What it is. The prediction product charges maker, taker, and settlement fees on $FIGHT-denominated entries across outcomes, methods, rounds, and performance props. Optional seasonal passes bundle discounted entries and premium features, while LP incentives reward liquidity depth and continuity.

Why it matters. This is our highest-frequency, UFC-synchronized surface: it activates every card, every week, and turns passive viewership into repeated, skill-based participation.

How value accrues to $FIGHT. Fees settle in $FIGHT and are split by policy between the DAO treasury, LP rewards, and an automated buyback/burn module. As leaderboards, FP multipliers, and club tournaments increase entry frequency and stake size, fee throughput—and therefore buyback/burn capacity—grows.

#

NFTs & Collectibles

What it is. Limited fighter highlights, achievement badges, and co-branded drops aligned to UFC moments and fighter community arcs.

Why it matters. Digital collectibles extend the story before and after fight night, give fans status objects tied to their FightID, and create programmable fan journeys (quests, tiers, and access keys).

How value accrues to $FIGHT. Primary sales, marketplace fees, and programmable royalties can be denominated in $FIGHT. A defined share of net proceeds routes to the DAO, supporting buybacks/burns and new creator/fighter drop grants.

#

Ticketing & Merchandise Rails

What it is. $FIGHT-enabled checkout and rewards for UFC-adjacent partners and events, from PPV codes and watch-party experiences to team gym activations.

Why it matters. Commerce is where mainstream fans live today. Letting them earn FP, redeem perks, and pay with $FIGHT lowers friction and connects everyday purchases to on-chain identity.

How value accrues to $FIGHT. Transaction fees and partner revenue-shares are settled in $FIGHT where supported, then routed to the DAO for buybacks/burns, with a portion earmarked for future ticketing rewards and fan refunds/credits that drive repeat usage.

#

FightGear

What it is. Capsule apparel drops and fighter collaborations, time-boxed around fight week and milestone events, with token-gated early access for $FIGHT holders and high-FP members.

Why it matters. Apparel is a viral surface that travels beyond crypto and converts social reach into identity claims and on-chain behavior.

How value accrues to $FIGHT. Checkout, holder discounts, and secondary royalties can be processed in $FIGHT. A programmable slice of net sales flows to the DAO, funding buybacks/burns and the next wave of collabs.

#

Prize$Fight

What it is. A programmable prize-pool framework for fighter bonuses, fan challenges, and event bounties (e.g., Finish of the Night, Upset of the Card), funded by sponsors, the DAO, or the community.

Why it matters. It translates fan enthusiasm into tangible rewards for athletes and creates compelling, card-specific reasons to show up and participate.

How value accrues to $FIGHT. Funding and entries are $FIGHT-denominated. A small protocol fee returns to the DAO to support buybacks/burns and future Prize$Fight campaigns—turning each bounty cycle into a recurring token sink.

#

Partnerships & Sponsorships

What it is. Revenue-share programs with gyms, leagues, creators, and distribution partners that integrate FightID, FP, and $FIGHT into their experiences.

Why it matters. Third-party surfaces expand reach without fragmenting identity, bringing new audiences into our UFC-synchronized cadence.

How value accrues to $FIGHT. Standardized splits return a portion of partner revenues to the DAO treasury in $FIGHT, increasing the pool available for buybacks/burns, liquidity programs, and builder grants that seed the next cohort of integrations.

#

Routing Policy and Flywheel

Value routing. A portion of all net revenues—prediction fees, collectibles, commerce rails, FightGear, Prize$Fight, and partner shares—flows to the DAO treasury in $FIGHT. Under transparent policy, the DAO allocates these proceeds to:

Buybacks and burns that reduce circulating supply over time,

Ecosystem grants and incentives that drive new product surfaces and user growth, and

Liquidity operations that keep onboarding smooth for mainstream fans.

Why it works. UFC’s global cadence supplies the distribution; FightID and FP convert that attention into repeated, value-creating actions; and $FIGHT-denominated revenues close the loop by funding buybacks/burns and the next wave of growth. The result is a compounding cycle where real usage directly supports token value—week after week, card after card.

#

Governance & the Fight Foundation

Structure and roles. Governance of the ecosystem is stewarded by the Fight Foundation (Cayman). The Foundation’s mandate is to safeguard the protocol, execute DAO-approved decisions, and ensure legal, treasury, and risk standards are met. Concept Labs acts as a core contributor—operating product, growth, and integrations—and is the holder of the UFC licensing and sponsorship relationships that support $FIGHT as an IP token. Advisory input flows through specialist working groups (Treasury, Risk & Integrity, Product/UX) and from the Athlete Council, which represents fighter perspectives on utility, incentives, and community safety.

Progressive decentralization. Governance authority migrates to token holders in stages:

Phase 1 (Launch Stewardship): The Foundation executes with DAO visibility and publishes treasury and emissions policies; emergency controls are narrowly scoped and time-limited.

Phase 2 (Delegate Program): $FIGHT holders elect or self-nominate delegates; working groups receive budgets with KPI-based accountability.

Phase 3 (Full DAO): On-chain execution with mandatory timelocks; most parameter changes and budgets pass through token voting with explicit quorum and veto limits.

Proposals and voting. Any $FIGHT holder can submit proposals once a minimal threshold (e.g., token stake or sponsorship by a delegate) is met. Voting occurs on-chain with clear quorum, majority, and timelock rules. FP (Fighting Force) points may be used as a reputation weighting/guardrail—for example, to gate proposal creation, to boost the voting power of proven contributors within capped bands, or to break ties—so that long-term, high-signal participation has measured influence without allowing reputation to override token consensus. All results, tallies, and execution transactions are public.

Treasury policy. Net revenues from $FIGHT-denominated utilities—prediction market fees, community memberships and upgrades, merch/ticket rails, FightGear royalties, Prize$Fight protocol fees, and partner revenue-shares—flow to the DAO treasury. Under published policies, the DAO allocates these proceeds to:

Buybacks and burns that reduce circulating supply over time;

Ecosystem grants (builders, fighters, creators) with milestone-based disbursements and clawbacks;

Liquidity programs that deepen markets and smooth onboarding;

Risk & security reserves for audits, oracle integrity, and dispute handling.

Budget allocations are reviewed on a regular cadence (e.g., quarterly) and require fresh votes to renew.

Transparency and controls. The Foundation maintains on-chain reporting for emissions, treasury balances, incoming fee streams, grants issued, and program outcomes. Key contracts are audited, parameter changes are timelocked, and all multisig signers are disclosed with rotation rules. Conflicts of interest are declared in proposal threads; any emergency powers are narrow, pre-defined, and sunset automatically unless reauthorized by token vote.

Why this governance model matters. Open, auditable governance builds trust with fans, fighters, partners, and regulators. It ensures that incentives are not changed behind closed doors, that the community can shape priorities, and that resources are deployed where they create the most value. The Athlete Council’s input keeps utility fighter-centric; working groups keep operations focused and accountable; and progressive decentralization ensures speed now without sacrificing long-term legitimacy.

How value accrues to $FIGHT. Rational treasury management ties real, recurring revenues to buybacks/burns and to the growth programs that create the next wave of usage. As prediction markets, communities, and commerce rails scale, fee throughput in $FIGHT increases; the DAO converts part of that throughput into reduced supply (burns) and part into higher utility (grants, liquidity, partnerships). Because token holders ultimately approve these policies, improvements to value capture feed back into $FIGHT itself, reinforcing the token’s role as the economic backbone of the ecosystem.

#

Athlete Council

What it is and who’s involved. The Athlete Council is a formal advisory body that ensures fighters’ voices directly influence product design, policy, and incentive structures across the Fight ecosystem. It is chaired operationally by Rob Winkler (GM, UFC Strike) and composed of active athletes and coaches who bring a real-world perspective on what resonates with fighters and fans. The Council’s role is not symbolic; it is integrated into the product and treasury process so that priorities like fairness, engagement, and athlete welfare are embedded from the outset. Initial public supporters previously highlighted include UFC athletes Josh Emmett, Gilbert Burns, Dan Ige, Vicente Luque, Alexandre Pantoja, and Gregory “Robocop” Rodrigues, as well as coach Eric Nicksick.

Mandate and scope. The Council advises on fighter-centric utility and experiences end to end:

Prediction markets: which props are meaningful, how to define “skill-based” formats, and where integrity or safety considerations apply.

Fighter communities: staking tiers, perk structures, membership mechanics, and codes of conduct that promote respectful, long-term fandom.

Content and programming: formats for AMAs, watch-alongs, training drops, and behind-the-scenes experiences that reward both fighters and committed fans.

Prize$Fight disbursements: criteria, nomination flows, and transparency standards for bonus awards and event bounties.

Principles and safety: upholding Fight Fair / Fight Together / Fight Through / Fight Forever in incentive design; championing anti-abuse practices; and recommending swift guardrails when new mechanics create unintended behavior.

Why it matters. Fighter-aligned governance is essential for legitimacy and distribution. When athletes help shape utilities and incentives, the products feel authentic, adoption rises, and the ecosystem earns trust from the broader UFC audience. Practically, the Council reduces the gap between what the community builds and what fighters actually want—lowering iteration cycles, improving retention in fighter communities, and increasing the likelihood that athletes actively promote Fight programs to their fans.

Compensation and alignment. Council members are compensated with streamed token awards from a DAO-overseen allocation, using cliffs and activity-based vesting. This structure rewards ongoing contributions (attendance, reviews, proposal feedback, campaign participation) and discourages purely nominal involvement. Clear contribution logs and milestone check-ins ensure accountability and make renewals or adjustments straightforward through DAO proposals.

Process and accountability. Council recommendations are recorded in public RFCs or proposal threads and routed through the relevant working group (e.g., Product/UX, Treasury, Risk & Integrity). Where budget is required—such as Prize$Fight pool top-ups or new community perk funding—requests move to token-holder vote under standard quorum and timelocks. This keeps fighter input front-and-center while preserving transparent, on-chain control by $FIGHT holders.

How value accrues to $FIGHT. Athlete-guided design improves participation quality and conversion at every step of the funnel. Better prediction props, more compelling community perks, and credible Prize$Fight criteria lead to more $FIGHT-denominated entries, stakes, and purchases. Those interactions generate fees that flow to the DAO, which—per policy—allocates a share to buybacks and burns (reducing circulating supply) and a share to growth programs (fueling the next wave of users and utilities). In short, the Athlete Council raises product-market fit with fighters and their fanbases, which increases throughput across all $FIGHT sinks and strengthens the token’s value loop over time.

#

Team, Partners, Investors & Advisors

#

Core contributors

James Zhang — Co-Founder & CEO (Concept Labs / Fight.ID). James leads Concept Labs and co-founded Fight.ID, driving the UFC-supported, identity-first strategy behind $FIGHT as an IP token. Public footprint confirming his role and UFC engagement includes his posts around Fight.ID × UFC initiatives and Concept Labs operations. https://www.linkedin.com/in/conceptarthouse LinkedIn

Alex Casassovici — Executive Director (Fight Foundation). A repeat founder/operator (Azarus; acquired by Animoca Brands), Alex steers token design, governance, and ecosystem growth, with a long track record building interactive, on-chain products. https://www.linkedin.com/in/zatmonkey LinkedIn

Najeeb Kudiya — Chief Legal Officer / General Counsel. Najeeb oversees commercial, regulatory, and IP matters (active CA Bar; former GC at Concept Art House), ensuring compliant rollout of token, markets, and partnerships. https://www.linkedin.com/in/najeebkudiya • CA Bar record: https://apps.calbar.ca.gov/attorney/Licensee/Detail/263505 Practising Law Institute+1

Rob Winkler — GM (UFC Strike; Athlete Council lead). Rob leads day-to-day for UFC Strike at Concept Labs and chairs fighter-facing programs that inform utilities like prediction props, Prize$Fight, and fighter communities. https://x.com/robwinkler • UFC × Concept Labs partnership context: https://www.ufc.com/news/ufc-and-concept-labs-announce-multi-year-partnership-publish-ufc-strike-digital-collectibles X (formerly Twitter)+1

Jordan Friedman — Chief Business Officer. Jordan drives capital strategy, exchange relationships, and commercial partnerships for $FIGHT, with public profiles reflecting his role. https://www.linkedin.com/in/jordan-friedman-237980139 • https://theorg.com/org/forbes/org-chart/jordan-friedman LinkedIn+1

Context: Concept Labs is the UFC-licensed publisher/operator behind UFC Strike; UFC publicly announced a multi-year partnership with Concept Labs, and UFC has also published its Fight.ID collaboration that underpins loyalty, Prize$Fight, and FightGear—core surfaces for $FIGHT. https://www.ufc.com/news/ufc-and-concept-labs-announce-multi-year-partnership-publish-ufc-strike-digital-collectibles • https://www.ufc.com/news/ufc-and-fightid-team-unite-mma-and-web3-communities UFC+1

#

Fractional CMO Partner

Hassan & the Stratosphere team — Growth / KOL / Fractional-CMO partner. Stratosphere is our external growth engine: a marketing firm that operates as a fractional CMO across Web3, coordinating top-tier KOL/influencer campaigns, creator collaborations, and partner activations around UFC fight weeks. The remit includes:

End-to-end go-to-market for product launches (identity quests, prediction markets, fighter clubs).

Creator/KOL orchestration with performance SLAs, attribution links, and anti-sybil checks tied to FightID.

Narrative and PR alignment with fighters, gyms, and league partners; asset kits for ambassadors; and real-time iteration during event windows.

Growth analytics (UTM trees, cohort retention, and funnel QA) to scale what works and cut what doesn’t.

Why this matters. Stratosphere reduces CAC by bringing battle-tested Web3 distribution and trusted KOL relationships, exactly when we need them—during UFC’s global windows of attention. The result is more FightID claims, higher FP accumulation, and deeper $FIGHT usage across prediction entries and community staking.

#

Investors & advisors (selected)

Institutional/strategic: Anthos Capital (https://anthoscapital.com), Aquanow Ventures (https://www.aquanow.com/ventures), Blockchain Coinvestors (https://www.blockchaincoinvestors.com/partners), Fabric VC (https://www.fabricvc.com), Jupiter (https://jup.ag), Memeland (https://www.memeland.com). LinkedIn+5LinkedIn+5Datanyze+5

Notable individuals:

Luca Netz (Pudgy Penguins / $PENGU) — consumer IP & brand distribution. https://x.com/LucaNetz • https://pudgypenguins.com/ NFT Evening

Yat (Yan) Siu (Animoca Brands; Sandbox/Open Campus ecosystem) — Web3 IP and ecosystem strategy. https://linktr.ee/yatsiu

Meow (Jupiter / Meteora, Solana) — liquidity, listings, and routing strategy on Solana. https://x.com/weremeow • https://jup.ag • https://www.meteora.ag UFC

#

Why this lineup matters (and how it drives value to $FIGHT)

Operator speed + sports IP credibility. A team that already ships UFC-licensed products (Concept Labs / UFC Strike) plus governance and token design veterans (Fight Foundation) means faster execution around fight-week calendars and fewer false starts. UFC’s own announcements provide first-party validation that compels mainstream partners and fans to engage. UFC

Distribution at scale. Stratosphere’s fractional-CMO model coordinates KOLs, creators, and fighter ambassadors to turn every UFC card into a growth moment. That distribution feeds the core funnel—UFC awareness → FightID → FP → $FIGHT—increasing high-intent users rather than vanity impressions.

Liquidity and integrations. Solana-native partners (e.g., Jupiter; Meteora) help optimize routing, depth, and listings, which lowers user friction and boosts throughput as prediction markets, community staking, and commerce rails scale. More throughput = more $FIGHT-denominated fees.

Net effect on token value. Better storytelling (Luca Netz, Memeland), ecosystem leadership (Yat Siu), and Solana market craft (Meow/Jupiter/Meteora) produce more high-signal surfaces where entries, memberships, upgrades, and royalties flow through $FIGHT. Under DAO policy, a share of net revenues routes to buybacks/burns and to ecosystem grants/liquidity, directly linking real usage to token value—card after card, season after season.

#

Roadmap (Event-Synchronized, Distribution-First)

#

Pre-TGE → TGE

During the pre-TGE phase, we publish the full emissions and governance specifications, expand the FightID quest program, and run UFC-tied fight-week funnels that rehearse our acquisition and retention motions. In parallel, we launch fighter ambassador campaigns with clear creative kits, performance SLAs, and FP-based rewards so that athletes and creators can reliably onboard their audiences.

Why this matters. Clear economics and transparent governance reduce uncertainty for partners and users, while fight-week rehearsals prove that our funnels convert mainstream attention into identity claims and repeat engagement.

How value accrues to $FIGHT. Each rehearsal pushes more users through FightID → FP → paid utilities, priming post-TGE demand for staking and entries that generate $FIGHT-denominated fees for the DAO’s buyback/burn engine.

#

Post-TGE (near-term)

Immediately after TGE, staking goes live with FP multipliers and leaderboards so that early adopters see tangible advantages for reputation. We also run the first Prize$Fight bounties to reward standout performances and superfans, and we light up $FIGHT rails for merch and tickets with UFC-adjacent partners where supported.

Why this matters. Fans get instant, meaningful utility on day one—stake to join fighter communities, earn boosted rewards via FP, and participate in visible prize moments.

How value accrues to $FIGHT. Staking locks remove tokens from circulation, community actions create recurring micro-fees, and commerce rails settle in $FIGHT where available; a share of net revenues flows to the DAO for buybacks/burns and growth programs.

#

Q1 2026

We launch Prediction Markets for fight outcomes and performance props, synchronized to the UFC calendar, and expand exchange coverage to improve routing depth and accessibility for new users. We also open additional partner surfaces that accept $FIGHT for access, entries, and upgrades.

Why this matters. Prediction Markets transform weekly cards into repeatable engagement loops, while broader listings reduce slippage and make participation simpler for mainstream fans.

How value accrues to $FIGHT. Maker/taker/settlement fees settle in $FIGHT, leaderboard mechanics increase entry frequency, and exchange depth supports higher throughput—all of which raise fee flow to the DAO and, in turn, buyback/burn capacity.

#

Q2–Q3 2026

We scale Fighter Communities with dynamic entry pricing and member dividends, deepen perk stacks (AMAs, watch-alongs, club tournaments), and roll out FightGear capsule drops tied to marquee events. FightGear business strategy and prototype merchandise to reach consumer testing. In parallel, we add additional league integrations and enable selective multi-chain access where partner distribution requires it—while keeping Solana as the economic hub.

Why this matters. Communities convert casual fandom into durable membership with real skin in the game, and apparel acts as a viral surface that reaches beyond crypto. New league and partner surfaces multiply places where identity, reputation, and ownership matter.

How value accrues to $FIGHT. Community stakes lock supply and generate program fees; FightGear purchases and royalties can be denominated in $FIGHT; new integrations add fresh sinks and revenue-share streams that route back to the DAO for buybacks/burns and ecosystem grants.

#

2027+

We begin the FightHub rollout—an interoperable network of partner apps and leagues that honor FightID, FP, and $FIGHT—and we onboard global fight organizations into the ecosystem. We also experiment with AR/VR fan experiences that use identity and reputation for access and progression. By this stage, the DAO operates a fully matured buyback/burn policy financed by real, diversified revenues. FightGear business model ready for launch with stand-alone P&L as the retail arm of the core digital product business.

Why this matters. FightHub turns our stack into a standard for combat-sports participation, compounding network effects as more partners and fans align on one identity, one reputation system, and one token. FightGear business adds value both in revenue and marketing adoption.

How value accrues to $FIGHT. Each new surface adds utility and fee streams denominated in $FIGHT; the DAO continually converts a share of those flows into reduced circulating supply (burns) and greater utility (grants, liquidity, partnerships), reinforcing token value as the ecosystem scales—card after card, season after season. FightGear phygital business generates profits and serves as social proof for $Fight marketing purposes.

#

Risk, Compliance, and Operating Principles

Purpose of this section. Our goal is to protect fans, fighters, and partners while keeping the product simple and fun. We do that by designing for legal compliance from day one, building strong guardrails around market integrity, operating with transparent economics, and holding ourselves to a clear set of principles that guide incentives and behavior.

#

Jurisdictional compliance

What we do. Features are delivered according to local laws. Experiences that may require licenses—such as prediction formats—are geofenced where necessary or offered via/alongside licensed partners. Product variants (e.g., skill-based fantasy formats with transparent scoring) are used in jurisdictions where they are the appropriate structure. Disclosures are plain-English, and access flows are simple: if a feature is restricted in a region, the UI makes that clear and offers compliant alternatives.

Why it matters. Compliance preserves long-term access to UFC-scale distribution and brand support. It removes ambiguity for partners and regulators, protects users, and reduces the risk of sudden product interruptions.

How value accrues to $FIGHT. A compliant footprint keeps features reliably available across fight weeks, so usage can compound. Consistent availability → more entries, stakes, and purchases → more $FIGHT-denominated fees that route to the DAO for buybacks/burns and growth.

#

Market integrity

What we do. Participation is anchored to FightID to deter multi-account abuse. We employ anti-sybil controls, device/behavioral checks, and staking velocity limits to discourage manipulation. Markets settle on oracle-verified results, and any discrepancies follow a transparent DAO arbitration path with documented SLAs and public outcomes. Monitoring flags anomalies in liquidity, pricing, or win rates so issues can be paused and reviewed quickly.

Why it matters. Integrity turns participation into habit. Fans return when they trust the results, the rules, and the payouts. Fighters and sponsors engage when abuse is rare and resolved quickly.

How value accrues to $FIGHT. Lower fraud and fewer disputes protect fee revenue and reduce user churn. That means a greater share of honest activity becomes throughput to the DAO—supporting buybacks/burns, LP programs, and grants that drive the next wave of usage.

#

Economic safety

What we do. We publish on-chain emissions and unlock schedules so everyone can see future supply—no hidden cliffs or surprise releases. Liquidity programs target healthy depth and routing rather than short-term spikes. Treasury operations follow written policies: fee intake → budgeted outflows (buybacks/burns, grants, liquidity) with public accounting and regular reporting.

Why it matters. Transparent, predictable economics reduce volatility and rent-seeking. Builders and partners can plan; fans can participate with confidence; and exchanges can support the token without fear of opaque supply shocks.

How value accrues to $FIGHT. Credible scarcity plus recurring fee sinks creates a durable value loop. As real usage grows, treasury policy converts a portion of those fees into reduced circulating supply and funds the utilities that attract the next cohort, reinforcing $FIGHT over multiple seasons.

#

Operating principles

Fight Fair. Design incentives that reward skill, effort, and honesty; resolve disputes openly.

Fight Together. Elevate fans, fighters, and creators with shared upside; keep programs inclusive and understandable.

Fight Through. Ship iteratively, measure openly, and fix problems fast—especially during live event windows.

Fight Forever. Build for longevity: compliance first, integrity by default, and economics that can sustain year after year.

Why it matters. Principles translate into product decisions under pressure—on weigh-in day, during main events, and in post-fight settlements. They help us prioritize user trust over short-term gains.

How value accrues to $FIGHT. When products are fair, reliable, and built to last, users stick around and do more. More participation drives more $FIGHT-denominated fees; DAO policy then channels those fees into buybacks/burns and growth. Over time, the compounding effect of principled operations is a stronger token and a healthier ecosystem.

#

References & Links (plain text for copy/paste)

Official + Product

Fight.ID (identity): https://fight.id

UFC Strike: https://ufcstrike.com

UFC × Fight.ID announcement (source)

Social

X (Fight.ID): https://x.com/JoinFightID

X (UFC): https://x.com/ufc

Ecosystem / Partners (selected)

- Jupiter: https://jup.ag

- Moonshot: https://moonshot.money/

- Meteora: https://www.meteora.ag

- Memeland: https://www.memeland.com

- Stakeland: https://www.stakeland.com/

- Animoca Brands: https://www.animocabrands.com

- Mocaverse: https://www.mocaverse.xyz/

- Pudgy Penguins: https://www.pudgypenguins.com/

- Combat Sports Agency: https://csagency.global/

- Stratosphere: https://www.stratosphere.vip/

- MarketAcross: https://marketacross.com/

Key Industry Investors / Advisors

- Luca Netz: https://x.com/LucaNetz

- Yat Siu: https://x.com/ysiu

- Meow (Jupiter/Meteora): https://x.com/weremeow

- Ray Chan (Memeland): https://x.com/9gagceo

Selected athlete supporters (official UFC profiles)

- Gilbert Burns: https://www.ufc.com/athlete/gilbert-burns

- Josh Emmett: https://www.ufc.com/athlete/josh-emmett

- Dan Ige: https://www.ufc.com/athlete/dan-ige

- Vicente Luque: https://www.ufc.com/athlete/vicente-luque

- Alexandre Pantoja: https://www.ufc.com/athlete/alexandre-pantoja

- Gregory “Robocop” Rodrigues: https://www.ufc.com/athlete/gregory-rodrigues